The Wikipedia definition of "controlled burn" reads as follows (emphasis mine):

Controlled or prescribed burning...is a technique sometimes used in forest management, farming, prairie restoration or greenhouse gas abatement. Fire is a natural part of both forest and grassland ecology and controlled fire can be a tool for foresters. Hazard reduction or controlled burning is conducted during the cooler months to reduce fuel buildup and decrease the likelihood of serious hotter fires.

A "Natural Part" Of Markets

If you'll humor me, you'll see that this definition could also describe the planet's stock markets. As we've learned through centuries of financial data, pullbacks are a natural part of financial markets that serve to reduce the buildup of speculative euphoria and decrease the likelihood of a serious bear market developing in a particular sector or market.

This brings us to Friday's widely publicized "Tech Wreck." Ahead of the weekend, the massive, former market-leading FAAMG stocks (Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT) and Google (NASDAQ:GOOGL)) led a big reversal in US tech stocks. As of writing, each of those stocks is trading off over 5% from their intraday highs and the Nasdaq 100 index of technology stocks is trading off by over 4% as a result.

This dramatic move predictably led to a cacophony of "top calls" for the broader market; after all, if the market leaders, which were the primary reason broader stock markets were rising in the first place, are losing steam, what's left to hold up the broader market? While we certainly can't rule out a major top at this point, we're still inclined to give the established uptrend the benefit of the doubt.

Fuel Buildup

There's no denying that the conditions for a pullback in the market-leading technology stocks were present. For instance, AMZN trades at a P/E ratio of 150 (or higher, depending on how you calculate it). Even if you love the company and its business model, can you honestly argue that a drop toward a valuation of 120 or even 100X earnings is unreasonable? While AMZN is the most egregious example, the other FAAMG stocks had also become the sort of no-brainer picks that becomes divorced from their fundamental business value.

Decrease The Likelihood Of A Serious Bear Market?

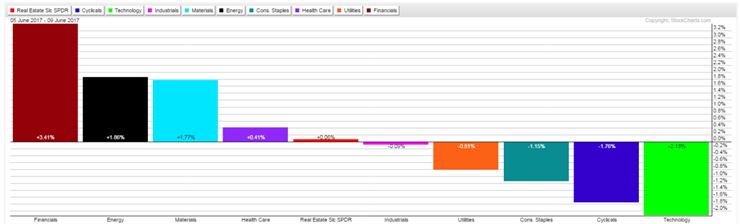

Instead of taking the glass-half-empty view that the long-term uptrend in US stocks will end as a result of Friday's reversal on tech stocks, we're looking at it as an opportunity for another sector to "take the reins." For instance, battered down financial, energy and material stocks all rose meaningfully last week, outperforming the technology sector by 4%+:

Source: Stockcharts.com

Strength in these generally pro-cyclical sectors tends to bode well for the broader market from a sector rotation perspective. Going back to our "controlled burn" analogy, the massive runup in technology stocks over the past couple of years built up a lot of fuel (late buyers) that inevitably would have caught fire (sold aggressively) at some point. Perhaps by seeing a pullback in tech stocks now, investors could be spared a massive bear-market blaze in the future and a new group of stocks can be allowed to grow (appreciate) in their place.